424B3: Prospectus filed pursuant to Rule 424(b)(3)

Published on September 28, 2015

Filed pursuant to Rule 424(b)(3)

Registration No. 333-201334

PROSPECTUS SUPPLEMENT NO. 2

(to prospectus dated August 4, 2015)

Aethlon Medical, Inc.

275,000 Shares of Common Stock

This prospectus supplement relates to the prospectus dated August 4, 2015 relating to the following common stock that may be sold from time to time by the selling stockholders identified in the prospectus:

| · | 275,000 shares of common stock underlying common stock purchase warrants at an exercise price of $15.00 per share. |

This prospectus supplement relates to an existing registration of securities under Registration Statement File No. 333-201334, originally filed on December 31, 2014, and does not cover securities beyond those covered by the existing Registration Statement.

All of the common stock covered by the prospectus is being sold by the selling stockholders for their own account. We will not receive any proceeds from the sale of these shares other than proceeds, if any, from the exercise of warrants to purchase shares of our common stock. If all of the warrants are exercised for cash, we will receive a total of $4,125,000 in gross proceeds, which we expect to use for general corporate purposes. We cannot assure you that any warrants will be exercised for cash. The selling stockholders may offer and sell the shares covered by the prospectus at prevailing prices quoted on the Nasdaq Capital Market or at privately negotiated prices. The selling stockholders may sell the shares directly or through underwriters, brokers or dealers. The selling stockholders will bear any applicable sales commissions, transfer taxes and similar expenses. We will pay all other expenses incident to the registration of the shares. See “Plan of Distribution” on page 30 of the prospectus for more information on this topic.

We are filing this prospectus supplement to supplement and amend the information previously included in the prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on September 28, 2015. Accordingly, we have attached our Current Report on Form 8-K to this prospectus supplement. You should read this prospectus supplement together with the prospectus and the prospectus supplement filed on August 13, 2015, which are to be delivered with this prospectus supplement.

Our common stock is traded on the Nasdaq Capital Market under the symbol “AEMD.” On September 24, 2015, the last reported sale price of our common stock on the Nasdaq Capital Market was $7.84 per share.

Investing in our securities involves significant risks, including those set forth in the “Risk Factors” section of the prospectus beginning at page 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THE PROSPECTUS OR THIS PROSPECTUS SUPPLEMENT IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is September 28, 2015.

1

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2015

AETHLON MEDICAL, INC.

(Exact name of registrant as specified in its charter)

|

Nevada (State or other jurisdiction of incorporation) |

001-37487 (Commission File Number) |

13-3632859 (IRS Employer Identification Number) |

|

9635 Granite Ridge Drive, Suite 100 San Diego, California (Address of principal executive offices) |

92123 (Zip Code) |

Registrant’s telephone number, including area code: (858) 459-7800

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in such filings, the words "anticipate,” "believe," "estimate," "expect," "future," "intend," "plan" or the negative of these terms and similar expressions as they relate to us or our management identify forward-looking statements. Such statements reflect our current view with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to our industry, our operations and results of operations and any businesses that we may acquire. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

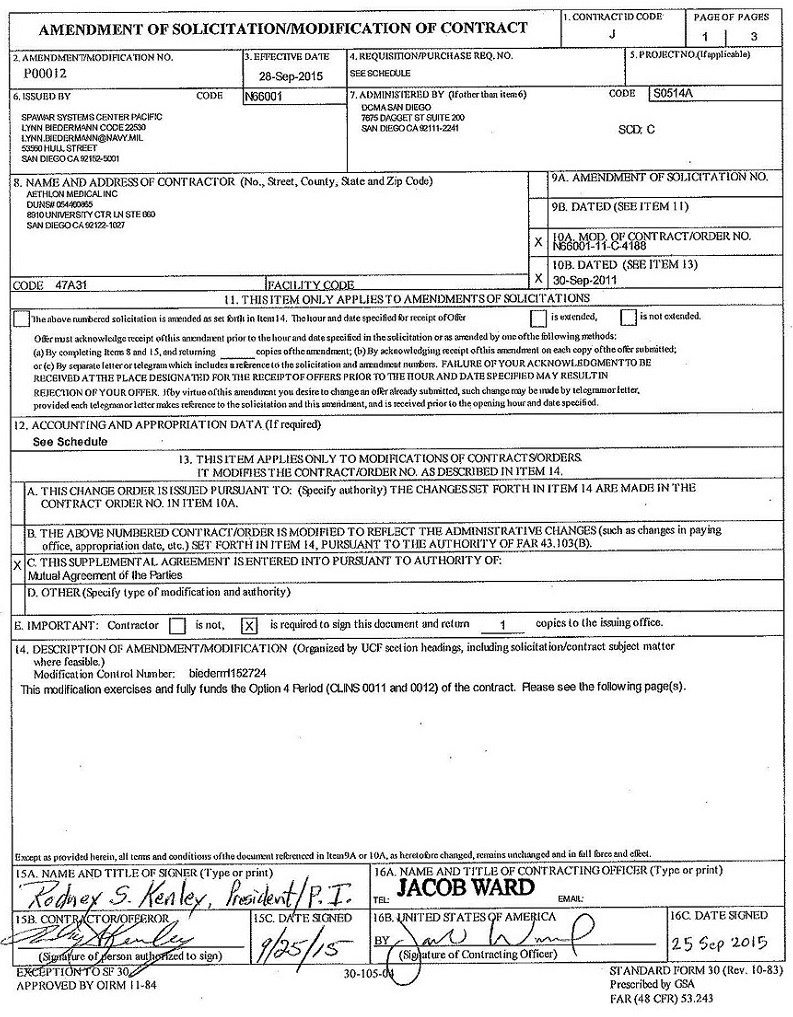

| ITEM 1.01 | ENTRY INTO A MATERIAL DEFINITIVE AGREEMENT. |

On September 25, 2015, Aethlon Medical, Inc. (“we”) entered into an extension of our contract with the Defense Advanced Research Projects Agency, or DARPA, part of the Department of Defense. We originally entered into the initial contract on September 30, 2011. DARPA entered into this contract extension in order to exercise its option to continue the contract for year five, the final year of the contract.

The DARPA contract is priced on a fixed-price basis. Pursuant to the contract extension, we have the potential to earn up to $581,157 in fixed payments upon our achievement of the milestones for year five of the contract.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. |

| (d) EXHIBITS | |

| EXHIBIT NO. |

DESCRIPTION

|

| 10.1 |

DARPA Contract Extension dated September 25, 2015

|

2

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AETHLON MEDICAL, INC. | ||||

|

By: /s/ James B. Frakes |

||||

| James B. Frakes | ||||

| Dated: September 28, 2015 | Chief Financial Officer |

3

EXHIBIT INDEX

| EXHIBIT NO. |

DESCRIPTION

|

| 10.1 |

DARPA Contract Extension dated September 25, 2015

|

4

Exhibit 10.1

N66001-11-C-4188

P00012

Page 2 of 3

SECTION SF 30 BLOCK 14 CONTINUATION PAGE

SUMMARY OF CHANGES

SECTION A - SOLICITATION/CONTRACT FORM

The total cost of this contract was increased by $581,157.00 from $5,354,839.00 to $5,935,996.00.

SECTION B - SUPPLIES OR SERVICES AND PRICES

CLIN 0011

The option status has changed from Option to Option Exercised.

CLIN 0012

The option status has changed from Option to Option Exercised.

SUBCLIN 001101 is added as follows:

| 001101 | Funding for Opt 4 MIPR# | ACRN | $581,157.00 |

| HR0011518340 | AH |

SECTION E - INSPECTION AND ACCEPTANCE

The following Acceptance/Inspection Schedule was added for SUBCLIN 001101:

| INSPECT AT | INSPECT BY | ACCEPT AT | ACCEPT BY |

| N/A | N/A | N/A | Government |

SECTION G - CONTRACT ADMINISTRATION DATA

Accounting and Appropriation

Summary for the Payment Office

As a result of this modification, the total funded amount for this document was increased by $581,157.00 from $5,354,839.00 to $5,935,996.00.

SUBCLIN 001101:

Funding on SUBCLIN 001101 is initiated as follows:

ACRN: AH

CIN: 130021178700011

N66001-11-C-4188

P00012

Page 3 of 3

Acctng Data: 9715160400 1320 BDL TTT20 1 5BT01C OR EADARP A255HR001151 83400200020602115E00 012199

Increase: $581,157.00

Total: $581,157.00

(End of Summary of Changes)