424B3: Prospectus filed pursuant to Rule 424(b)(3)

Published on April 14, 2015

Filed pursuant to Rule 424(b)(3)

Registration No. 333-201334

PROSPECTUS SUPPLEMENT NO. 5

(to prospectus dated January 28, 2015)

Aethlon Medical, Inc.

495,000 Shares of Common Stock

This prospectus supplement relates to the prospectus dated January 28, 2015 relating to the following common stock that may be sold from time to time by the selling stockholders identified in the prospectus:

| · | 220,000 shares of common stock; and |

| · | 275,000 shares of common stock underlying common stock purchase warrants at an exercise price of $15.00 per share. |

All of the common stock covered by the prospectus is being sold by the selling stockholders for their own account. We will not receive any proceeds from the sale of these shares other than proceeds, if any, from the exercise of warrants to purchase shares of our common stock. If all of the warrants are exercised for cash, we will receive a total of $4,125,000 in gross proceeds, which we expect to use for general corporate purposes. We cannot assure you that any warrants will be exercised for cash. The selling stockholders may offer and sell the shares covered by the prospectus at prevailing prices quoted on the OTCQB Marketplace or at privately negotiated prices. The selling stockholders may sell the shares directly or through underwriters, brokers or dealers. The selling stockholders will bear any applicable sales commissions, transfer taxes and similar expenses. We will pay all other expenses incident to the registration of the shares. See “Plan of Distribution” on page 28 of the prospectus for more information on this topic. The selling stockholders originally purchased the common stock and warrants from us on December 2, 2014, for an aggregate price of $3,300,000. The prospectus covers the sale of those securities by the selling stockholders.

We are filing this prospectus supplement to supplement and amend the information previously included in the prospectus with the information contained in our Current Report on Form 8-K filed with the Securities and Exchange Commission on April 14, 2015, regarding a 1-for-50 reverse stock split of our common stock that was effected on April 14, 2015. Accordingly, we have attached our Current Report on Form 8-K to this prospectus supplement. You should read this prospectus supplement together with the prospectus and the prospectus supplements filed on February 10, 2015, March 16, 2015, April 7, 2015 and April 14, 2015, which are to be delivered with this prospectus supplement. We have adjusted all share-based amounts set forth in this prospectus supplement to reflect the reverse stock split. You should view all outstanding share amounts and all shares underlying options, warrants or other securities exercisable or convertible into common stock set forth in the prospectus and the other prospectus supplements referred to herein as accordingly adjusted to reflect the reverse stock split.

Our common stock is quoted on the OTCQB Marketplace under the symbol “AEMD.” On April 13, 2015, the last quoted sale price of our common stock as reported on the OTCQB Marketplace, as adjusted for the reverse stock split, was $10.00 per share.

Investing in our securities involves significant risks, including those set forth in the “Risk Factors” section of the prospectus beginning at page 4.

NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR DISAPPROVED OF THESE SECURITIES OR DETERMINED IF THE PROSPECTUS OR THIS OR ANY OTHER PROSPECTUS SUPPLEMENT IS TRUTHFUL OR COMPLETE. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

The date of this prospectus supplement is April 14, 2015.

| 1 |

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): April 9, 2015

AETHLON MEDICAL, INC.

(Exact name of registrant as specified in its charter)

|

Nevada (State or other jurisdiction of incorporation) |

000-21846 (Commission File Number) |

13-3632859 (IRS Employer Identification Number) |

|

9635 Granite Ridge Drive, Suite 100 San Diego, California (Address of principal executive offices) |

92123 (Zip Code) |

Registrant’s telephone number, including area code: (858) 459-7800

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) | |

| ¨ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) | |

| ¨ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) | |

| ¨ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

FORWARD-LOOKING STATEMENTS

This Form 8-K and other reports filed by us from time to time with the Securities and Exchange Commission contain or may contain forward-looking statements and information that are based upon beliefs of, and information currently available to, our management as well as estimates and assumptions made by our management. When used in such filings, the words "anticipate,” "believe," "estimate," "expect," "future," "intend," "plan" or the negative of these terms and similar expressions as they relate to us or our management identify forward-looking statements. Such statements reflect our current view with respect to future events and are subject to risks, uncertainties, assumptions and other factors relating to our industry, our operations and results of operations and any businesses that we may acquire. Should one or more of these risks or uncertainties materialize, or should the underlying assumptions prove incorrect, actual results may differ significantly from those anticipated, believed, estimated, expected, intended or planned.

Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee future results, levels of activity, performance or achievements. Except as required by applicable law, including the securities laws of the United States, we do not intend to update any of the forward-looking statements to conform these statements to actual results.

| ITEM 5.03 | AMENDMENTS TO ARTICLES OF INCORPORATION OR BYLAWS; CHANGE IN FISCALYEAR. |

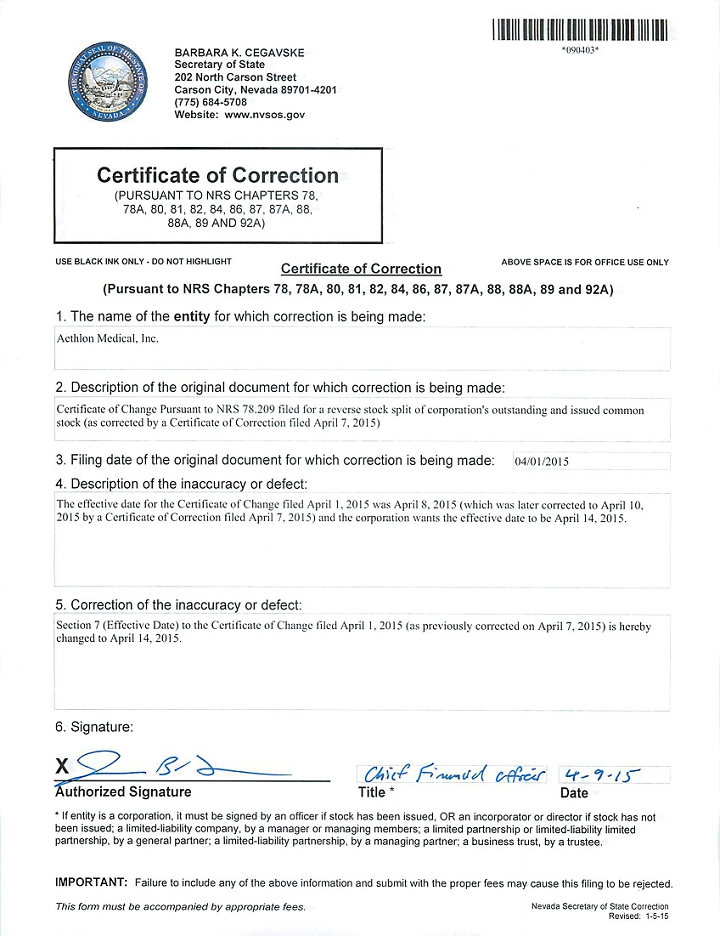

On April 9, 2015, Aethlon Medical, Inc. (“we”) filed a Certificate of Correction with the Secretary of State of the State of Nevada to provide that the 1-for-50 reverse stock split of both our authorized and our issued and outstanding common stock, which we previously reported on our Current Report on Form 8-K filed April 7, 2015, will become effective on April 14, 2015. We had previously disclosed on the referenced Current Report on Form 8-K that we had filed a Certificate of Change and a Certificate of Correction on April 1, 2015 and April 7, 2015, respectively, with the Secretary of State of the State of Nevada for the purpose of effecting the reverse stock split. Today, the effective date of the reverse stock split, our total authorized shares of common stock were reduced from 500,000,000 shares to 10,000,000 shares, and each 50 shares of our issued and outstanding common stock held by our stockholders were combined into one share of our common stock. We did not issue any fractional shares as a result of the reverse stock split. If the reverse stock split would have resulted in the issuance of a fractional share to any stockholder, we issued one whole share to such stockholder in lieu of the fractional share. The reverse stock split was approved by our Board of Directors. Pursuant to Nevada law, the approval of the stockholders was not required to effect this reverse stock split.

The foregoing description of the Certificate of Correction does not purport to be complete and is qualified in its entirety by the document filed as Exhibit 3.1 hereto.

| 2 |

| ITEM 8.01 | OTHER EVENTS. |

On April 14, 2015, we issued a press release announcing that the reverse stock split is effective today, and that our common stock will begin trading on a split-adjusted basis when the market opens today. Our common stock is quoted on the OTCQB Marketplace and will trade on a split-adjusted basis under the temporary symbol “AEMDD,” with the “D” appended to signify that the reverse stock split has occurred. The trading symbol will revert to “AEMD” after approximately 20 trading days.

The reverse stock split reduced our outstanding common stock from approximately 332,000,000 shares to approximately 6,700,000 shares. As noted above, our authorized shares were reduced proportionately from 500,000,000 shares to 10,000,000 shares. Proportional adjustments also will be made to the terms and exercise prices of outstanding options and warrants and to the conversion terms of our outstanding convertible notes. The par value of our common stock will remain at $0.001 per share after the reverse stock split. The new CUSIP number for our common stock following the reverse stock split is 00808Y208.

Stockholders who have existing stock certificates will receive written instructions by mail from our transfer agent to exchange their shares of common stock. Stockholders who hold their shares in brokerage accounts or "street name" are not required to take any action to effect the exchange of their shares of common stock. Such stockholders will be contacted by their brokers with instructions.

A copy of our press release is filed as Exhibit 99.1 hereto.

| ITEM 9.01 | FINANCIAL STATEMENTS AND EXHIBITS. | |

| (d) EXHIBITS | ||

| EXHIBIT NO. | DESCRIPTION | |

| 3.1 | Certificate of Correction filed April 9, 2015 | |

| 99.1 | Press Release dated April 14, 2015 | |

| 3 |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| AETHLON MEDICAL, INC. | ||||

|

By: /s/ James B. Frakes |

||||

| James B. Frakes | ||||

| Dated: April 14, 2015 | Chief Financial Officer |

| 4 |

Exhibit 3.1

| 5 |

Exhibit 99.1

Aethlon Medical Announces Effectiveness of Reverse Stock Split

SAN DIEGO, April 14, 2015 /PRNewswire/ --Aethlon Medical, Inc. (OTCQB:AEMD), a pioneer in developing targeted therapeutic devices to address infectious diseases and cancer, announced today that its previously disclosed 1-for-50 reverse stock split is effective as of today, April 14, 2015, and that the Company's common stock will begin trading on a split-adjusted basis when the market opens today. The Company’s common stock will trade on a split-adjusted basis under the temporary symbol "AEMDD," with the "D" appended to signify that the reverse stock split has occurred. The trading symbol will revert to "AEMD" after approximately 20 trading days.

The reverse split reduces the number of shares of the Company's common stock outstanding from approximately 332 million to approximately 6.7 million. Proportional adjustments were made to the Company's authorized shares, and will be made to the terms and exercise price of outstanding options and warrants, as well as the conversion terms of the Company’s outstanding convertible notes. Any fractional shares resulting from the reverse stock split will be rounded up to the next whole share. The par value of the Company's common stock will remain at $0.001 per share after the reverse stock split. The new CUSIP number for the Company's common stock following the reverse stock split is 00808Y208.

INFORMATION FOR STOCKHOLDERS

Stockholders who have existing stock certificates will receive written instructions by mail from the Company's transfer agent, Computershare. Stockholders who hold their shares in brokerage accounts or "street name" are not required to take any action to effect the exchange of their shares. Such stockholders will be contacted by their brokers with instructions.

About Aethlon Medical, Inc.

Aethlon Medical creates medical devices that target unmet therapeutic needs in infectious disease and cancer. The company's lead product is the Aethlon Hemopurifier®, a first-in-class device that selectively targets the rapid elimination of circulating viruses and tumor-secreted exosomes that promote cancer progression. Exosome Sciences, Inc. is a majority owned subsidiary that is advancing exosome-based products to diagnose and monitor cancer, infectious disease and neurological disorders. Additional information can be found online at www.AethlonMedical.com and connect with the Company on Twitter, LinkedIn, Facebook and Google+.

| 6 |

Certain statements herein may be forward-looking and involve risks and uncertainties. Such forward-looking statements involve assumptions, known and unknown risks, uncertainties and other factors which may cause the actual results, performance or achievements of Aethlon Medical, Inc. to be materially different from any future results, performance, or achievements expressed or implied by the forward-looking statements. Such potential risks and uncertainties include, without limitation, that Exosome Sciences, Inc. will not be able to commercialize its future products, including any that can be described as a liquid biopsy, that the FDA will not approve the initiation of the Company's future clinical programs or provide market clearance of the Company's products, future human studies, whether revenue or non-revenue generating, of the Aethlon ADAPT™ system or the Aethlon Hemopurifier® as an adjunct therapy to improve patient responsiveness to established cancer or hepatitis C therapies or as a standalone cancer or hepatitis C therapy or as a broad spectrum defense against viral pathogens, including Ebola, the Company's ability to raise capital when needed, the Company's ability to complete the development of its planned products, the Company's ability to manufacture its products, either internally or through outside companies, and provide its services, the impact of government regulations, patent protection on the Company's proprietary technology, the ability of the Company to meet the milestones contemplated in the DARPA contract, product liability exposure, uncertainty of market acceptance, competition, technological change, and other risk factors. In such instances, actual results could differ materially as a result of a variety of factors, including the risks associated with the effect of changing economic conditions and other risk factors detailed in the Company's Securities and Exchange Commission filings. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events, or otherwise.

Contacts:

James A. Joyce

Chairman and CEO

(Office) 858.459.7800 x301

(Cell) 619-368-2000

jj@aethlonmedical.com

Jim Frakes

Chief Financial Officer

858.459.7800 x300

jfrakes@aethlonmedical.com

| 7 |